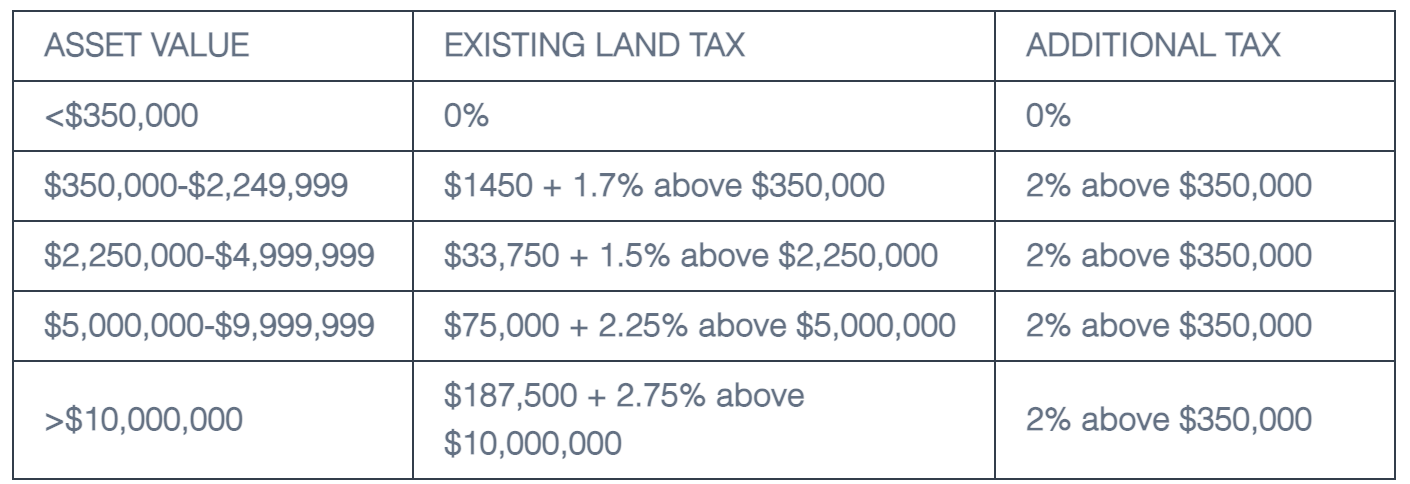

In June 2019, the Queensland state government proposed an additional 2% land tax on land-owning foreign trusts or companies for properties valued over $350,000. The tax would impact all property classes. However, its ramifications would be focused particularly on commercial (particularly office) tenants.

For example, the existing land tax on a $7,500,000 property is $131,250. The additional tax is $143,000, bringing total potential land tax to $274,250 under the proposed adjustment.

The majority of non-residential leases allow landlords to pass statutory outgoings such as land tax onto tenants. This would result in increased outgoings for tenants. Domestic owned office buildings would become increasingly competitive, offering better value to tenants with lower relative outgoings. Furthermore, this would provide some support to domestic-owned asset valuations.

The impact of QLD’s proposed additional land tax on a tenant is dependent on 3 key variables:

The greater the area leased and the greater the valuation of the landlord’s asset (for example, an office tower in central Brisbane is generally worth more than the equivalent building in Rockhampton), the greater the potential negative impact.

In the above example, if a $7,500,000 property has a single tenant (i.e. 100% of lettable area), it is likely that the tenant would face an extra $143,000 of annual outgoings expense.

Recently, German property group, Deka Immobilien, purchased an A-Grade Brisbane office building at 66 Eagle St for $380 million (yielding around 5.3%) from Lendlease and The Abu Dhabi Investment Authority. Despite the potential additional land tax (a hefty $7,593,000), Deka outbid domestic competition including GPT and Charter Hall.

Demand from foreign buyers for similar buildings is likely to soften in the short term if the proposed additional land tax is passed. However, the QLD commercial property market would likely remain attractive in the long term, with relatively high yields and perceived safety supporting foreign interest.

Considering leasing from a foreign landlord? Affected and confused by land tax?

Tenant CS is a commercial tenant advisory service that caters to companies across Australia, Singapore and the greater Asia-Pacific region. We have an offices at the heart of Sydney’s CBD, as well as in Melbourne and Singapore.

Contact our team today for assistance with your next lease negotiation!

Want to know more first? Click here to read our Commercial Leasing Agreement Checklist before signing on the dotted line, or here to read about why it pays to have a tenant advisor on your side!